E-invoicing: what companies can expect

Receipt of electronic invoices mandatory from 2025The Federal Council approved the Growth Opportunities Act (WCG) on March 22, 2024. This means that from 2025, all companies in domestic B2B business transactions must be able to receive e-invoices.

With the “VAT in the Digital Age” initiative, the EU Commission aims to modernize VAT law, reduce the costs of companies’ tax obligations and combat VAT fraud more effectively. The associated requirements are being implemented similarly, but not identically, in the EU member states.

In Germany, the reform will take place in three steps, which are set out in the WCG. From 2025, companies must be able to receive and process e-invoices in a structured format. From 2027, they should also be able to issue and send them. Another year later, the tax authorities also want to introduce an electronic reporting system.

Zukünftig gilt eine Rechnung nur dann als E-Rechnung, wenn sie in einem elektronisch strukturierten Format ausgestellt, übermittelt und empfangen werden kann. Auch eine elektronische Verarbeitung muss möglich sein. Eine Papier- oder PDF-Rechnung, die per E-Mail versendet wird, entspricht grundsätzlich nicht diesen Anforderungen.

- Automated invoice creation in defined formats ensures high data quality and stability.

- By sending documents electronically, companies can save on postal delivery times and the costs associated with sending documents by post.

- Electronic processing enables efficient invoice verification and therefore prompt payment transactions.

- In particular, an e-invoice format must ensure that the mandatory invoice details in accordance with Section 14 (4) UStG can be transmitted and read electronically.

- The use of structured invoice formats based on EN 16931 is always permitted.

- In addition, EDI procedures in accordance with Article 2 of Recommendation 94/820/EC can also be used under certain conditions.

between Dr. Christian John and Tim Geier on the subject of e-billing

InterviewSupport with implementation

E/D/E and ETRIS BANK have a project team that supports members in implementing the requirements on time. Further useful information is also available at e-rechnung-bund.de or verband-e-rechnung.org.

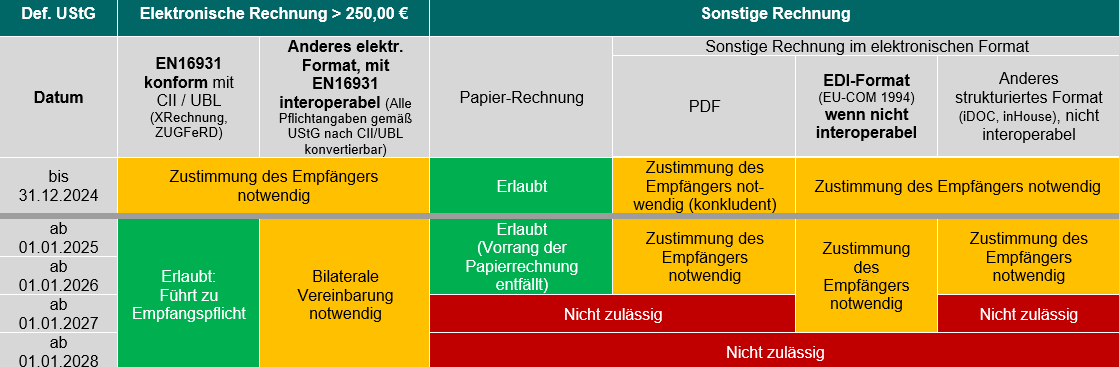

Overview of permissible invoice transmissions in Germany B2B:

Note: The above information is non-binding and does not claim to be complete or correct. It does not constitute legal or tax advice.

between Dr. Christian John and Jörg Glaser on the subject of e-billing

Interview

Dr. Christian John

Jörg Glaser

The e-invoicing obligation as a preliminary stage of the EU efforts under the heading “VAT in the digital age” – the aim being to prevent VAT abuse – and as part of the Growth Opportunities Act was really hidden and was not so obvious at first. The obligation didn’t reach the relevant target group (EDI managers, those responsible for tax returns, etc.). But then the EDI scene of the association groups erupted in outrage, not least because the much-used EDIFACT was not initially included in the draft as a permissible digital format. This has since changed thanks to the efforts of the associations. Perhaps for some, the idea that paper or PDF would be replaced in b2b business from 2025 was simply so abstruse that the adaptation projects were set up late.

Yes, in case of doubt, the IT experts at the association group headquarters “only” have to deal with additional data exchange formats whose process suitability has to be tested. The well-known EDI and document management service providers are prepared (and are happy about more business…). The WWS providers are in demand from the affiliated and member companies, but they are also preparing intensively for this, as I recently learned first-hand from GWS in Münster, for example. And finally, the buying association of the tax consultants DATEV now has completely integrated offers in the accounting system to support the clients in the program.

The Federal Ministry of Finance (BMF) is working hard to adapt the electronic invoice to the requirements. DER MITTELSTANDSVERBUND-ZGV e.V. has been asked to submit a statement on further specifications in a BMF letter announced for the 4th quarter by mid-July. The leading association of cooperating SMEs now has the advantage of directly questioning the affected IT experts of the association groups in our IT management working group, which we have done. Tenor: It’s actually good that EDI management finally has a lever for digitizing invoice exchange.

I don’t believe that the obligation will change in principle. There are also various transitional periods. As far as the other projects within the EU’s “VAT in the digital age” topic are concerned (keyword, delivery of invoices to a portal of the tax authorities), there are regular reports from our office in Brussels (colleague Tim Geier) about changed deadlines.

This has always been the case with all formats and standards in electronic data exchange. Changes are decided in the committees, which then appear in different release versions in practice. However, when the tax office portal comes into play from 2028 (perhaps also 2030), this issue should (hopefully) be resolved.

Yes, we are all talking about AI with growing enthusiasm and for the most part are leaving the wealth of data and the process benefits of digital invoice data exchange unused. I actually see the electronic invoice as a booster for the digitalization of this area in medium-sized member and affiliated companies, even if new regulations in times of excessive bureaucracy in the SME sector represent an initial effort.

Start the project early so that there is enough time for testing!

Link collection

Further information can be found in thisWe are happy to help you

Your contact persons

Team EDI-Services